One stand-out feature from 2023 was the polarisation of executive hiring across private-held software towards Chief Revenue Officers (CROs) and Chief Financial Officers (CFOs). Whilst this makes complete sense in a time of change and peak valuations, this trend is showing no signs of change as 2024 gets into its stride. That said, the demand is evolving and some interesting characteristics are emerging.

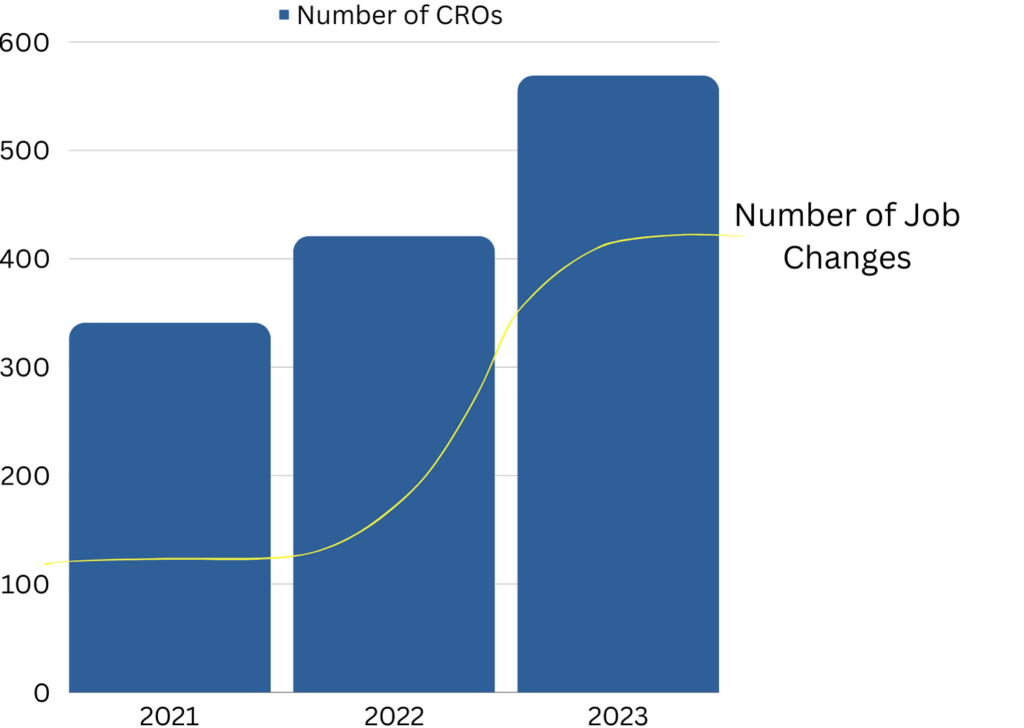

Figure 1: The number of CRO’s in privately-held SaaS business with over $50m funding round in past 3 years who have a prior exit plus the number of jobs changes in 2023.

For both functions, management experience and track record are becoming bigger demands. Revenue is harder to grasp and financials are more vulnerable, but there is a clear preference for leadership that has seen it before. Efficient growth might be the phrase, but the talent requirement is favouring those who have been there and done it. In the CRO function, we are seeing more and more requests for team management, precision metrics and GTM integration at scale – this all smacks of more proven leaders. For CFOs, having a way to navigate choppy waters and get a precise understanding of business performance is ringing loud and clear from founders and investors alike.

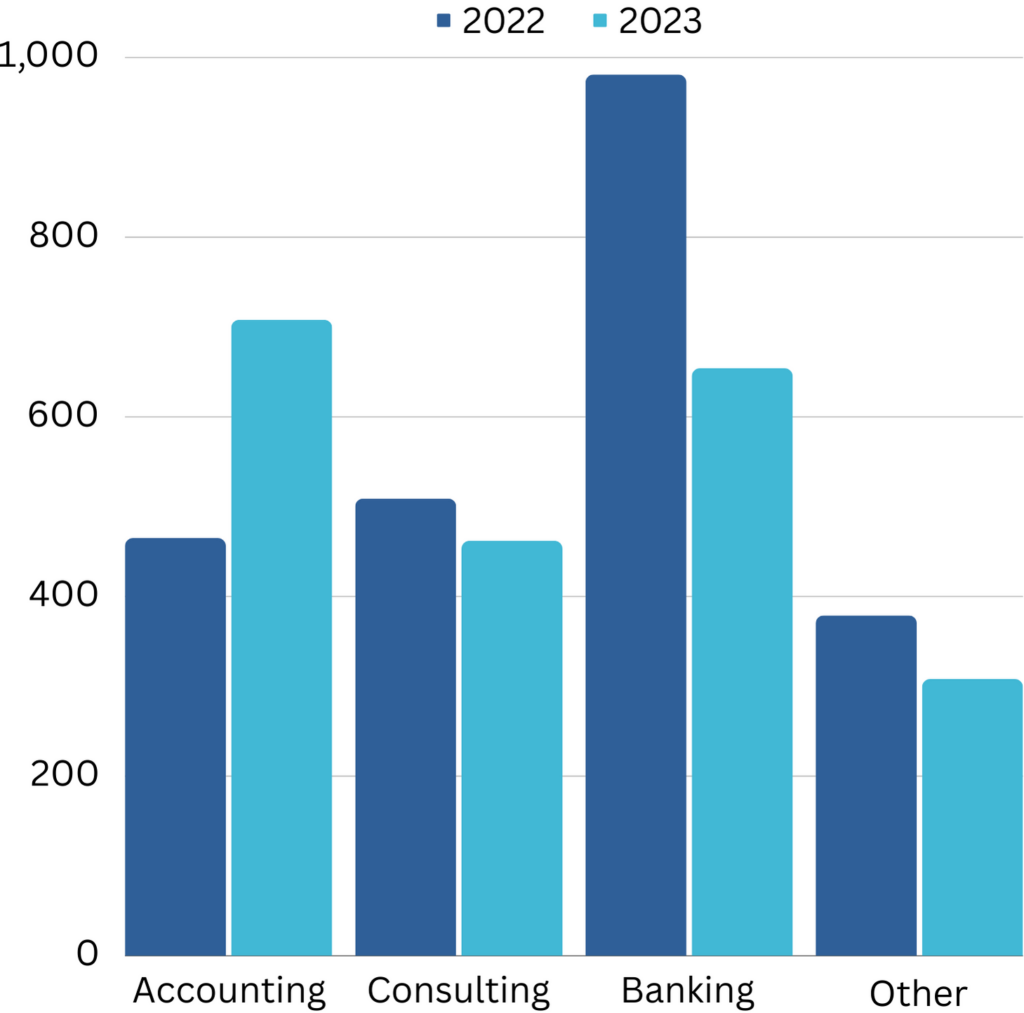

Figure 2: A comparison of the number of CFOs in privately-held SaaS business in 2022 and 2023, based on their professional background.

The consequences of this are somewhat stark for the appropriate talent pools. CROs with no exit track records or less of experience management scale are getting moved out and the proven leaders are coming in – one founder remarked, “I’d rather have 10% of the pipeline in than bank by end of Q1, than $150m of vapour.” For the CFO audience, the market moves are similar. Former bankers, consultants and non-qualified finance leaders are feeling increased heat from founders and investors to run a tight ship and shore up the numbers and extend the runway. Those who are not are getting replaced with a more traditional approach focused on the day-to-day and more financial control. It’s evident the criteria for success in these roles are becoming more stringent, with a greater emphasis on immediate impact and visible contributions. We expect this to increase throughout 2024.

For more content from Faraday Partners, follow us on LinkedIn.