The executive talent shortage in technology across the EMEA region is acute and accelerating. This fact is shaping the future of emerging and growing companies and increasingly dictating their ability to successfully deliver their vision. This profound shift is a major threat to the EMEA tech ecosystem and its ability to prosper in the next period of growth.

Post-economic Talent Realities

In the aftermath of the 2020-2 boom, the EMEA region finds itself at an executive talent crossroads. While the period of rapid growth and numerous exits has resulted in a larger-than-ever pool of post-economic talent, most of this talent is shying away from taking on new company-building challenges. The personal demands of such roles, including time investment, career risk and the quest for a more balanced life, have led many to seek more stable and less demanding opportunities. We are seeing start-up winners seeking out public company roles; those who loved Seed and Series A looking for late-stage PE situations and many exceptional and proven operators not wanting full-time roles. Executive talent in EMEA tech is shifting its focus permanently.

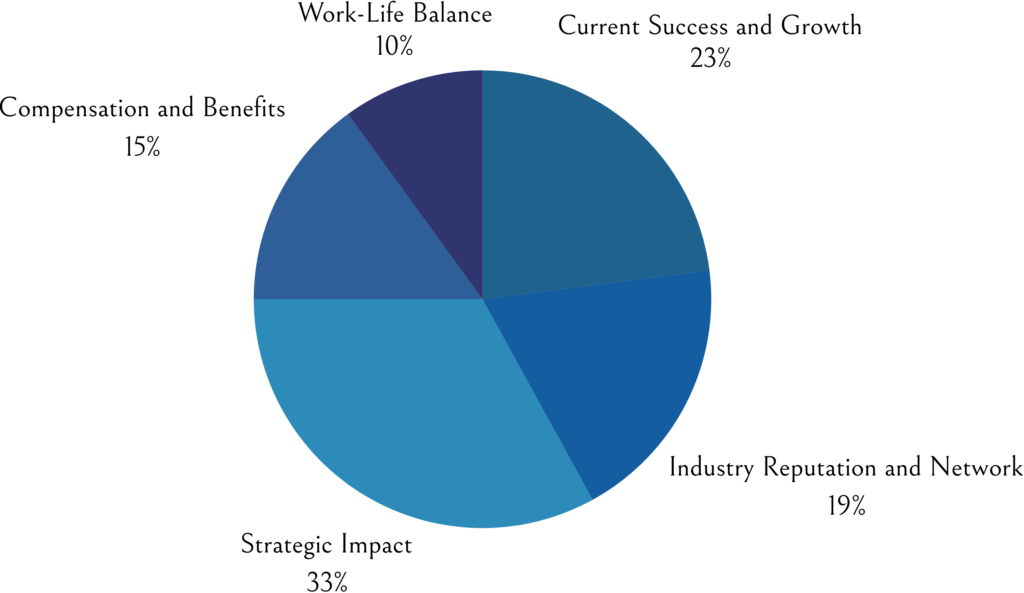

Figure 1: The five main reasons why proven executives in EMEA tech are not considering new full-time opportunities.

Plural Panaceas?

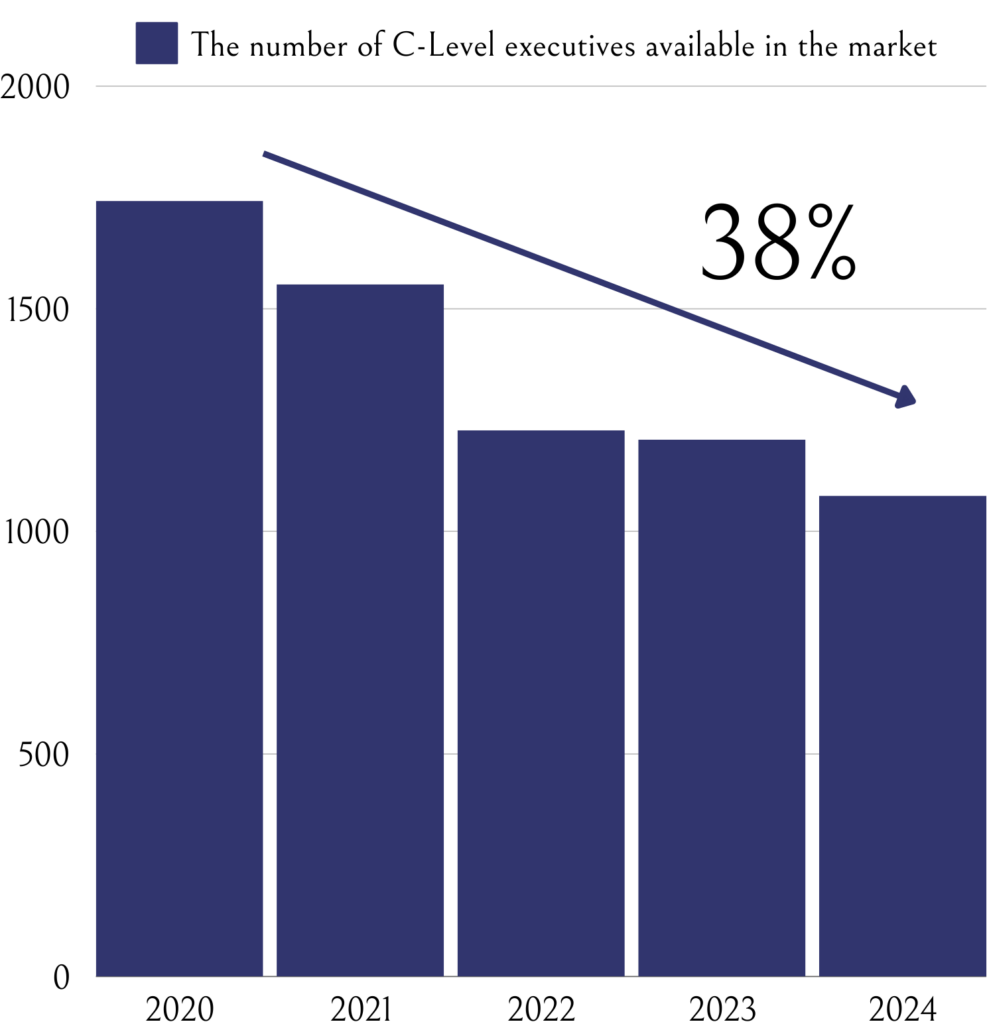

One notable trend among successful tech executives in EMEA is a pivot towards Board responsibilities or portfolio/fractional careers. This shift is driven by a desire for roles that offer flexibility, less personal day-to-day time demand and the opportunity to leverage valuable/unique expertise across a selection of companies. This move, however, is sucking vital experience away from executive teams and companies struggling with the ongoing and incremental challenges of company building. The executive talent market in tech in EMEA is, as such, shrinking profoundly in a critical period. Faraday’s research is showing that the availability of C-Level executives with at least one successful tech exit for a full-time role has fallen by 38% since 2020 in EMEA.

Figure 2: Between 2020 and 2024, there is a 38% decrease in candidates with one exit in a C-Level

position under their belt who would take another full-time role.

The Opportunities and Pitfalls Ahead

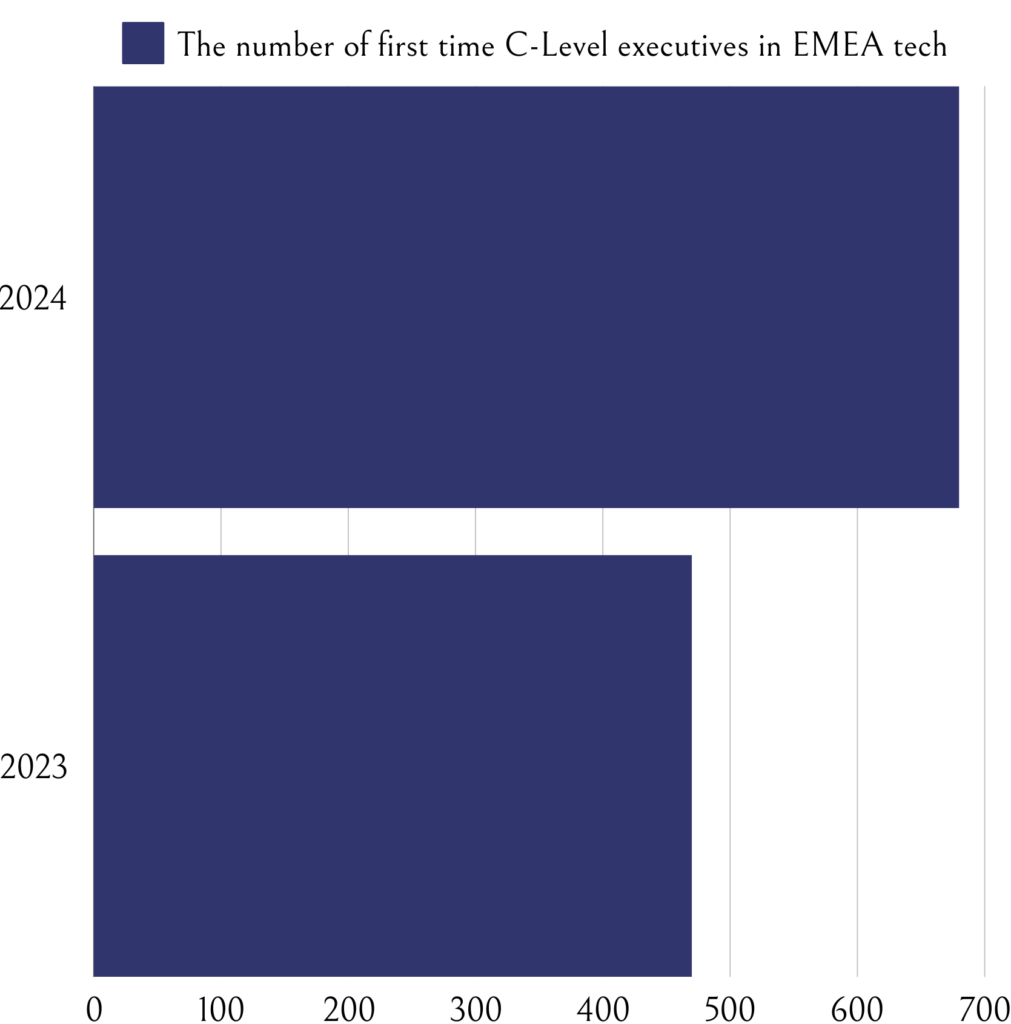

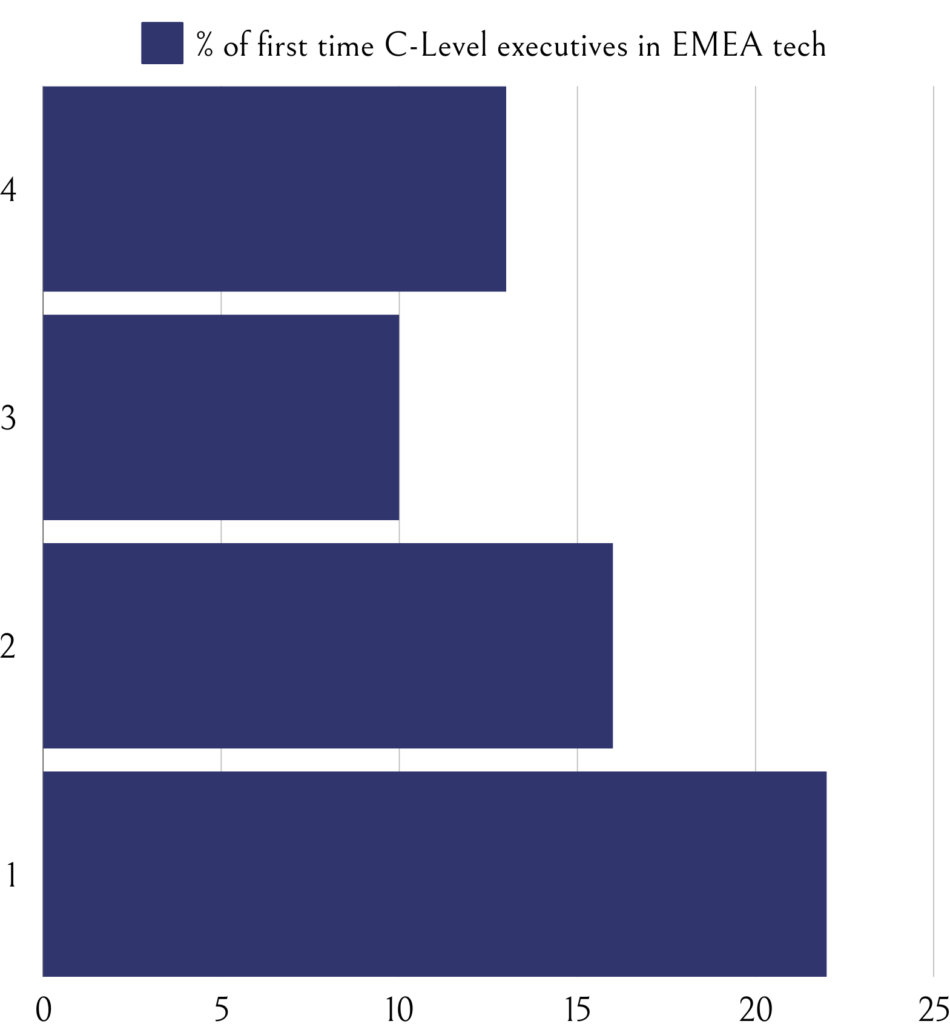

This talent scarcity does, however, open the door for ‘step-up’ candidates – those on the brink of defining their careers by stepping into leadership roles earlier than might have been traditionally expected. Whilst the philosophy of capability trumping experience rings true with certain candidates and industries such as AI, the level of talent risk of less proven executives is perilous for many founders, Boards and investors. Founders and leadership teams are facing an ongoing challenge to judge and guide less-proven executives to develop their executive skills and impact in a challenging market context. This is risky and time-consuming and often a result of a failed executive hiring campaign or the lack of funding to attract and secure experienced talent. All-in-all this context heightens the fragility of businesses seeking to grow in tech and history shows us that the majority of step-up candidates move on within 36 months of their first full leadership role.

Figure 3: 2023 vs 2024 – The number of first time C-Level executives in EMEA tech.

Figure 4: A comparison of tenure period (1-4 years) for first time C-Level executives in EMEA tech.

In response to this context, we are seeing more founders and investors seeking to source international talent for key executive positions. There are undoubtedly more and more US-based executives open to EMEA roles and the experience and track record profile is undoubtedly stronger. That said, this is not a silver bullet solution and often pitfalls like relocation and onboarding risks endure. Furthermore, we are seeing existing Board members, in particular, activating personal networks and connections to persuade their former colleagues to come into the companies they govern. Whilst this is a good solution, it can often be overtly politicised and is not scalable. The only reliable solution to a narrower market is to plan even better with a longer time horizon and build a more definitive understanding of the hire envisaged. Cutting through in a tight talent pool works, however, we find many founders still unable to fully articulate what they need compellingly and deliver it effectively to any experienced executive, let alone the most proven experts. That signals a broader issue than just the availability of proven talent.

For more content from Faraday Partners, follow us on LinkedIn.