In the evolving narrative of 2024’s startup ecosystem, founders find themselves at a significant crossroads. The landscape, though dotted with pockets of optimism due to improved market conditions and anticipated economic growth, casts a long shadow of dilemma over leadership decisions, particularly in executive hiring. This nuanced scenario is not merely a reflection of the economic climate but a testament to the strategic quandaries confronting founders. Successfully navigating the pathway to the right leadership team is the core challenge for founders going forward.

Navigating the Hiring Conundrum

Founders report a more promising market environment with fewer economic restrictions than in recent years, fuelled by a positive outlook for technology and IT spending. Despite this, the decision to embark on leadership hiring programs is met with hesitation, underscoring a broader concern: the timing and impact of such decisions on future growth.

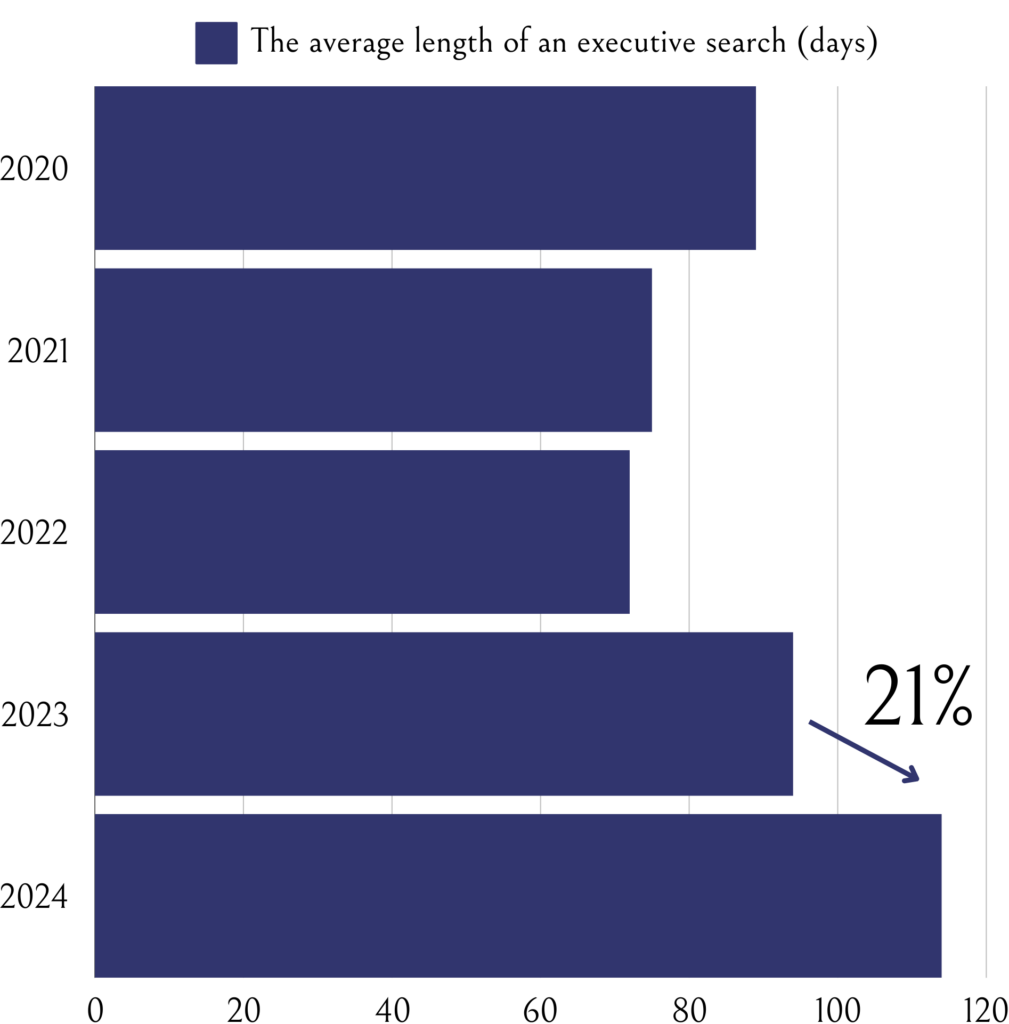

Figure 1: The average length of executive search processes has shown a 21% increase in the last year.

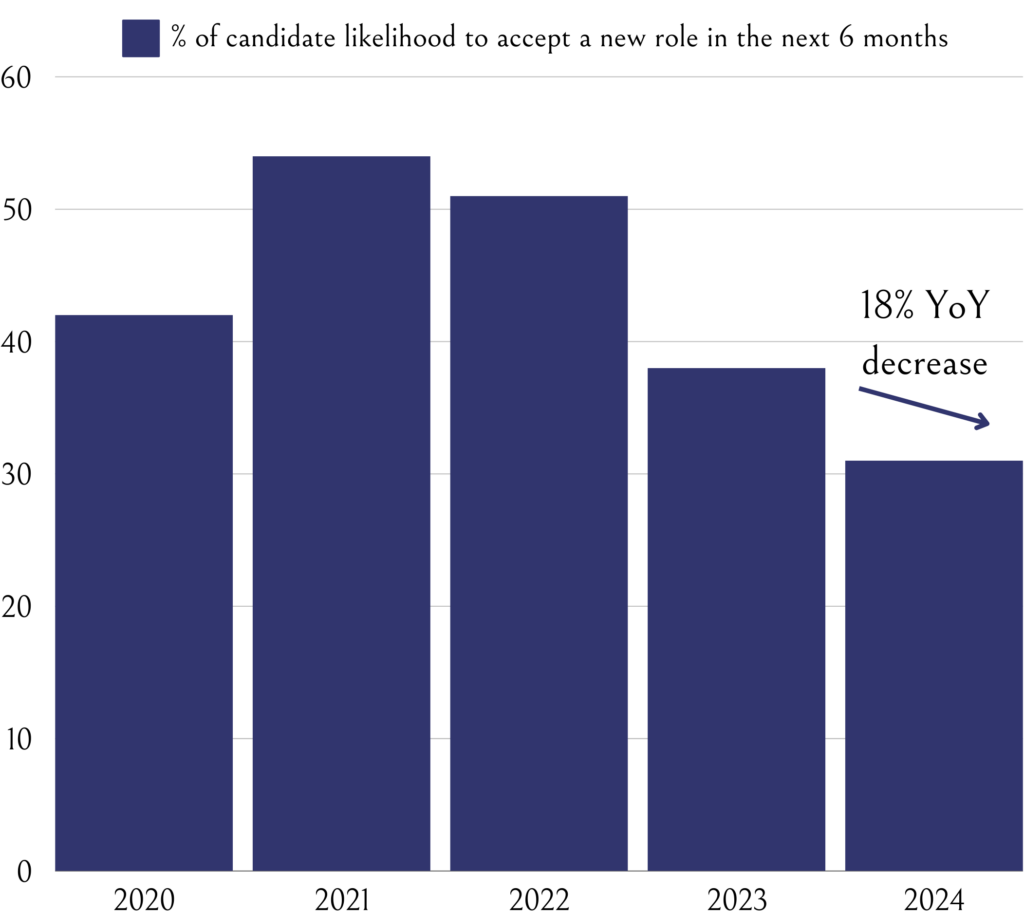

This hesitation is not unfounded. The gap between deciding on an executive hire and the eventual onboarding of new leadership is widening – Faraday’s industry-wide research is showing a 21% increase in the average length of executive search processes in venture capital to well over 100 days across all executive functions. This time factor is curbing start-ups’ ability to fully leverage a recovering market opportunity. This delay is compounded by widespread caution amongst proven and experienced executives about making career changes in an uncertain climate. Executives surveyed by Faraday remain as open to hearing about opportunities as ever before, but their likelihood of accepting a new role between the start of Q2 and the end of Q3 2024 has dropped by 18% YoY. Personal economic security coupled with the risk of change remain the key reasons and prompt many to stay put or keep looking.

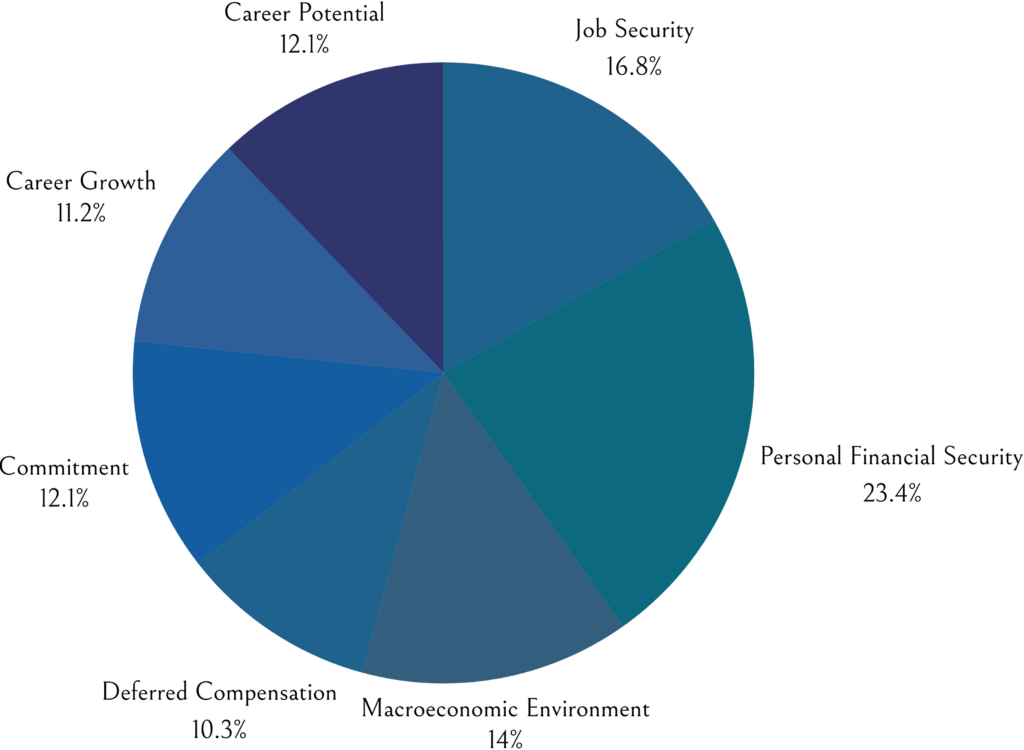

Figure 2: A spread of reasons why executive candidates prefer to remain in their current role.

Figure 3: The percentage of candidate likelihood to accept a new role in the next

6 months saw an 18% YoY decrease between 2023 and 2024.

The Reactive Hiring Predicament

This confluence of factors nudges founders towards a reactive hiring model, driven by the availability of executive candidates rather than their suitability or excellence. In a market where timing is crucial, the readiness to hire often clashes with the quality of available talent and this is being compounded more than ever by market circumstances and the executive candidate’s outlook. The compromises made in a reactive executive hire nearly always impact long-term growth, business efficiency, overall team tenure and company culture.

Founders aiming for swift hires are thus more likely to engage with the current pool of actively seeking executives. This scenario paints a stark picture of the executive talent landscape in tech for 2024, marked by a high risk of mismatched expectations and capabilities, potentially stalling critical growth trajectories and recovery. Faraday’s research alone showed that 24% of CRO appointments in EMEA in SaaS start-ups in Q4 2023 were with executives that were not in employment at the time of the hire and 43% of those executives had less than 24 months tenure in their most recent role.

Strategic Implications and Moving Forward

Many Founders and Boards are looking for definitive proof of recovery before making changes to their executive teams. The reality is that this is likely to be too late in a tight employment market. Whilst many Founders know they do not have the right executive teams to prosper, the decisions to make change are often delayed or convoluted. Further, candidate availability and Founder uncertainty are making executive hiring processes longer and more complex with more variables. In a time when many need to capture fresh opportunities, the capability for the right executives seems further away than ever before for many.

What we are seeing from the most proficient founders, Boards and investors is an increased focus on organisational planning and data to judge how and when to hire. Getting ahead of a complex problem in an uncertain environment and having options to capitalise or extend caution is the most effective way to navigate this period. That said, we simply see few focusing in this way. We hear more and more about desperation to hire, poorly defined roles and responsibilities, negative hiring processes and a lot of disjointed behaviours across the tech executive hiring arena. This is likely a key determinant in a tech sector recovery. As the year unfolds, the ability of founders, Boards and investors to address these dilemmas with foresight and flexibility will likely define the success trajectories of startups in a post-pandemic and rapidly evolving economic landscape.

For more content from Faraday Partners, follow us on LinkedIn.