If there is one sound bite that will endure from 2023 is ‘runway extension’ and every possible derivative thereafter. Whilst playing for time in an uncertain macro-economy is completely understandable, it has led to some unforeseen organisational consequences that are now leading to more profound issues in business viability and growth. In short, many founders are reporting that they don’t have the leaders who can succeed in a complex market, but they fear if they fire them they will not have the sponsorship to appoint replacements with more expertise. So, sticking with what you have might keep you moving on a longer timeline, but performance remains below expectations and hinders the ability to capitalise on a recovering market.

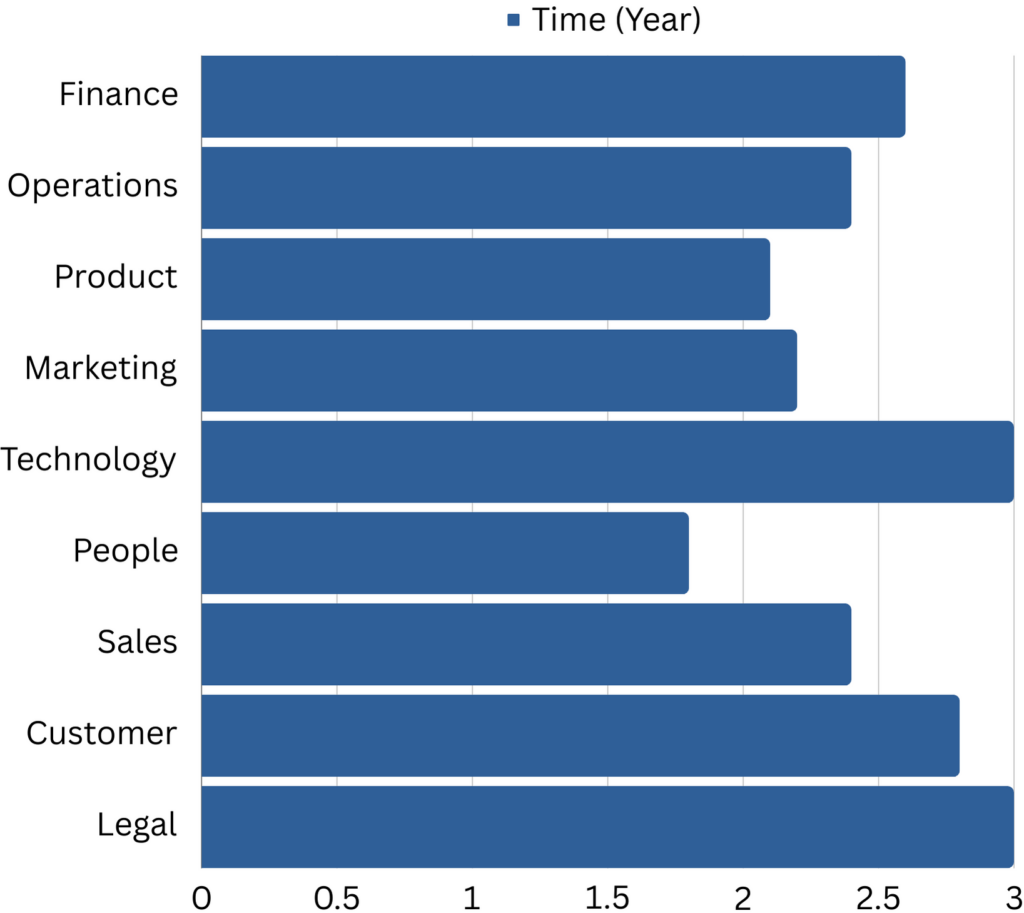

Figure 1: The management tenure of functional leaders in private technology companies in Europe with more than $20m fundraise since 2021.

One meeting with a founder recently confirmed this scenario. “I know my Board is going to block any spending on finding better talent. My CMO is underweight and struggling but if I make a change I cannot replace them other than finding someone through the network. Our chance of winning is being limited by a combined reluctance to make change. It’s like we are saying we are happy to die slowly in 2025, when if we make some hard choices we could make it through easily. I feel like the gamblers have put the dice away.” This sentiment appears widespread and pressure is building each day.

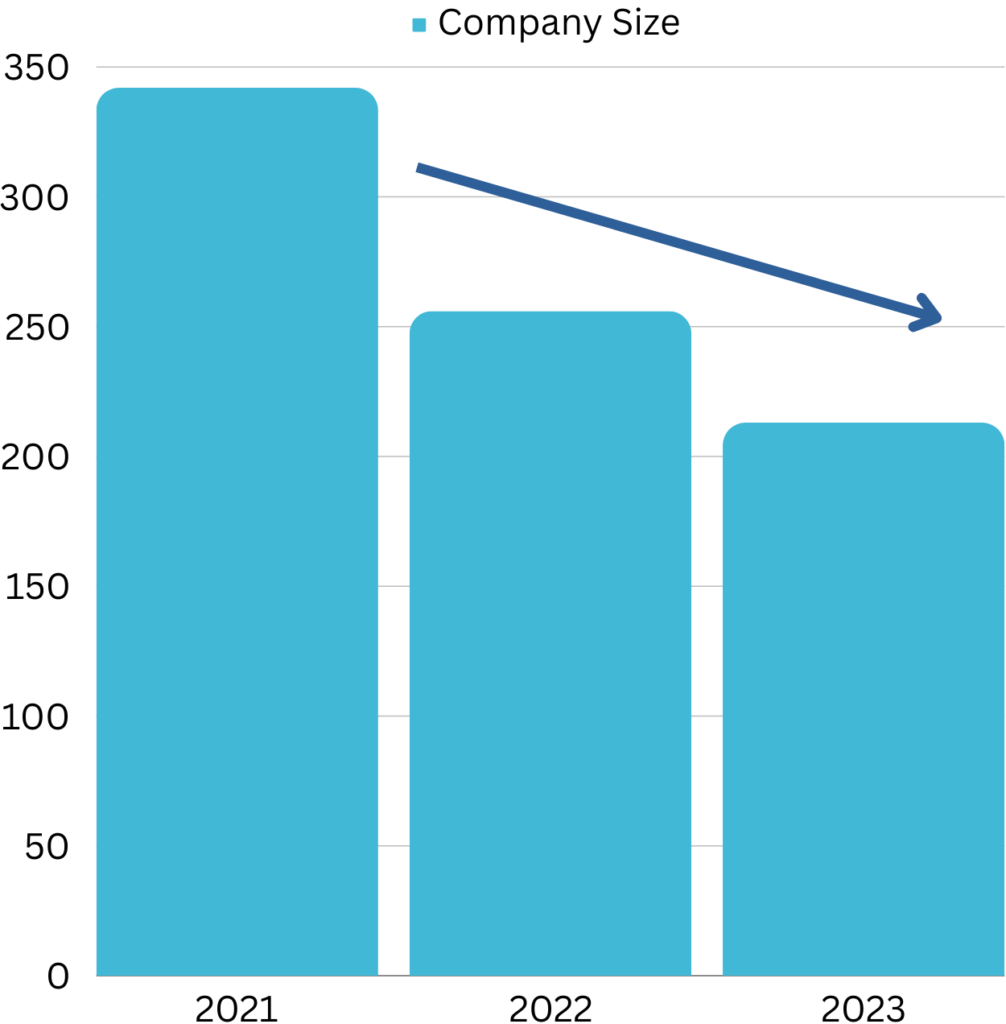

Figure 2: The organisational size of private technology companies in Europe with more than $20m fundraise since 2021.

We are seeing some of the more prosperous businesses begin to take action. In addition to revenue and finance leaders, there has been a refresh of product and marketing leadership hires coming together. Those with conviction and good data are seeing the strengthening of leadership and expertise as a way to win. Furthermore, there are pockets of expert leadership talent who are prepared to take increased risks in an uncertain period knowing their knowledge can drive outcomes for less mature companies. Whilst this requires some bravery and boldness, those who are capitalising on market volatility to upgrade their leadership teams are beginning to see some green shoots. The challenge for many is they still may have the wrong people on board and feel unable to take decisive action.

For more content from Faraday Partners, follow us on LinkedIn.