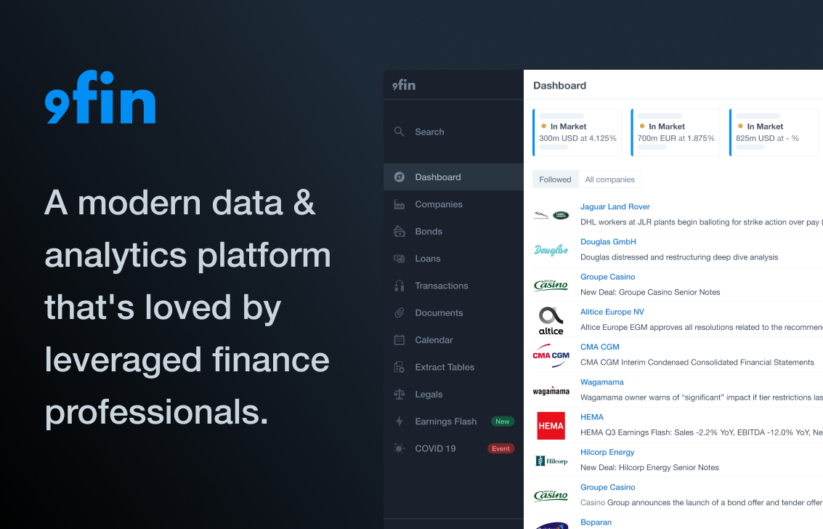

9fin, a London-based fintech startup, secures $23 million in funding to bolster its AI-powered data and analytics platform for debt markets. With a strong focus on outperforming competitors, winning business, and saving time, 9fin aims to expand its footprint globally, particularly in North America.

London-based fintech startup 9fin has raised $23 million in a Series A+ funding round, led by Spark Capital with participation from existing investors. The company’s AI-powered data and analytics platform aims to revolutionise debt markets, offering advanced business intelligence to financial services clients. With a focus on outperforming peers, winning business, and saving time, 9fin plans to utilize the funding to accelerate its expansion into North American markets.

Despite debt markets being the world’s largest asset class, many participants rely on outdated technology for analysis. 9fin’s platform, which goes beyond mere updates by integrating AI-driven solutions, has gained traction with over 60 customers, including major investment banks, debt advisors, European HY Sales & Trading desks, and leading law firms in debt capital markets.

9fin CEO and co-founder, Steven Hunter, expressed enthusiasm about the business’s success in Europe and the opportunity to expand in the US. The funding round, not initially planned, will support the growth of 9fin’s US team, with a focus on hiring across credit, legal, and sales functions.

Source – Tech.eu

For more content from Faraday Partners, follow us on LinkedIn.